Prevailing Wage and Davis-Bacon Compliance in Oregon

eMars provides certified payroll and compliance solutions tailored primarily for federal projects and select state jurisdictions. While many agencies accept the standard WH-347 form, some states will require their own form. For questions about supported jurisdictions, please contact our team directly.

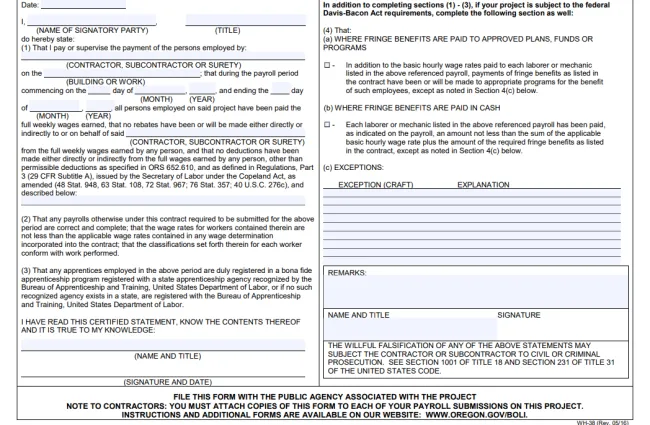

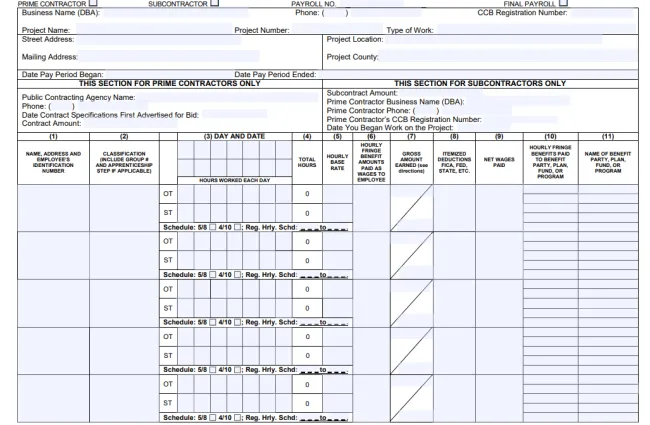

Oregon WH-38 Form Now Available in eMars

eMars is pleased to announce that the Payroll/Certified Statement Form (WH-38) is now fully supported within our platform for contractors and subcontractors working on Oregon public works projects governed by the Prevailing Wage Rate (PWR) Law under ORS 279C.845.

The WH-38 form allows contractors to easily report weekly payroll information and certify compliance with Oregon's prevailing wage requirements. It captures all key details required by the Oregon Bureau of Labor and Industries (BOLI), including work classifications, fringe benefit provisions, and total hours and wages reported. The WH-38 form includes the certified statement of compliance, verifying all information is complete and accurate, and can be signed electronically in eMars.

With the WH-38 now integrated directly into eMars, users can produce a fully complete WH-38 directly from their payroll with one mouse click. There is no copying and pasting, no extra steps, and no manual entry.

Simplify Oregon prevailing wage reporting with eMars.

Components of Wage Determinations

Both federal and state wage determinations in Oregon include:

- Basic Hourly Rate: The minimum wage rate paid directly to workers in a specific job classification.

- Fringe Benefits: Non-cash benefits include health insurance, pensions, and vacation pay.

- Total Hourly Rate: The sum of the basic hourly rate and fringe benefits.

Compliance for Contractors and Subcontractors

Contractors and subcontractors working on public works projects in Oregon must:

Determine Applicable Wage Rates

Determine Applicable Wage Rates

For federal projects: Use the U.S. Department of Labor's Wage Determinations Online (WDOL) portal via SAM.gov.

For state projects: Wage rates are provided by the Oregon Bureau of Labor and Industries (BOLI).

Submit Certified Payroll Reports

Submit Certified Payroll Reports

For federal projects: Use the U.S. Department of Labor's Form WH-347.

For state projects: Reports must be submitted to BOLI.

Ensure Correct Wages

Ensure Correct Wages

Post Wage Rates On-Site

Post Wage Rates On-Site

Maintain Accurate Records

Maintain Accurate Records

Penalties for Non-Compliance

Failure to comply with prevailing wage laws in Oregon can result in:

-

Back pay for underpaid workers

-

Fines

-

Disqualification from bidding on future public works projects

Unique Aspects of Oregon's Prevailing Wage System

- Locally Determined Wage Rates: Oregon calculates prevailing wages based on state-conducted surveys of local wage data and collective bargaining agreements, ensuring region-specific accuracy.

- Apprenticeship and Training Promotion: The system actively supports apprenticeship programs by encouraging contractors to hire and train apprentices on public works projects, fostering workforce development.

- Strong Enforcement Mechanisms: Oregon's prevailing wage system includes stringent compliance monitoring and penalties for violations, ensuring contractors adhere to wage standards.

Relevant Resources

- Oregon Bureau of Labor and Industries (BOLI) Prevailing Wage Information: BOLI Prevailing Wage Information

- U.S. Department of Labor: Wage Determinations Online (WDOL): SAM.gov - Wage Determinations

Certified Payroll Form WH-347: U.S. Department of Labor Certified Payroll Form

For the most accurate and current information on prevailing wage requirements, consult the U.S. Department of Labor or your state's official labor website.

Oregon Prevailing Wage FAQs

Does Oregon have its own prevailing wage law?

Yes, Oregon has its own prevailing wage law known as the Oregon Prevailing Wage Rate Law. This law requires contractors working on state-funded public works projects to pay workers the prevailing wage rates established by the Oregon Bureau of Labor and Industries (BOLI).

How are prevailing wage rates determined for public works projects in Oregon?

For state-funded projects, prevailing wage rates are determined by the Oregon Bureau of Labor and Industries (BOLI) through wage surveys and are updated semi-annually. For federally funded projects, wage rates are determined by the U.S. Department of Labor based on local wage surveys.

What are the penalties for non-compliance with prevailing wage laws in Oregon?

Penalties for non-compliance can include fines, the requirement to pay back wages to underpaid workers, and potential disqualification from bidding on future public works contracts.

How are fringe benefits handled under Oregon’s prevailing wage laws?

Contractors must either provide fringe benefits such as health insurance, retirement plans, or vacation pay, or they must pay the equivalent value in cash. If no fringe benefits are provided, the contractor must pay the total hourly wage (basic wage + fringe benefits) in cash to the worker.