Davis-Bacon Act For Employers

What is the Davis-Bacon Act?

The Davis-Bacon Act is a landmark piece of legislation in the United States that sets out essential wage requirements for public works and construction projects. Originally passed in 1931 and amended in 2002, it was designed to protect workers from being underpaid for their work on public projects, thereby ensuring fair wages and promoting healthy competition among contractors.

Key Features of the Davis-Bacon Act

Wage Definitions: The Act introduces specific wage definitions, including the basic hourly pay rate, medical or hospital care, pensions on retirement or death, compensation for occupational injuries or illness, unemployment benefits, and other similar fringe benefits.

Rate of Wages for Laborers and Mechanics: For every government contract exceeding $2,000 related to the construction, alteration, or repair of public buildings and works, minimum wages must be specified based on the prevailing wages determined by the Secretary of Labor.

Contract Stipulations: Contractors or subcontractors must pay workers on-site at least once a week without any subsequent deductions. The scale of wages must also be posted prominently at the work site.

Discharge of Obligation: Contractors or subcontractors can fulfill their obligation to pay the prevailing wage through cash payments, contributions to benefit plans, and assuming the costs of benefit plans.

Overtime Pay: The Act provides guidelines for calculating overtime pay for laborers or mechanics.

Key Employer Obligations

In addition to these obligations, employers must also adhere to various reporting and record-keeping requirements, such as maintaining a copy of the wage determination included in the contract, maintaining payroll records for all laborers and mechanics for a period of three years, and submitting certified weekly payrolls to the contracting agency.

Paying Prevailing Wages

Employers are obligated to pay their workers the prevailing wages for the locality where the work is performed. The prevailing wage is determined by the Secretary of Labor and is usually based on what workers receive in the area for similar projects.

Weekly Pay

Employers must pay their workers weekly. The full amount due at the time of payment, as computed at the wage rate specified in the contract, must be paid unconditionally, without subsequent deductions or rebates.

Fringe Benefits

If specified in the determination of the prevailing wage rate, employers must provide their workers with certain fringe benefits. These benefits can include medical or hospital care, compensation for occupational injuries or illnesses, unemployment benefits, life insurance, disability and sickness insurance, pensions upon retirement or death, and other similar benefits.

Davis-Bacon Act History

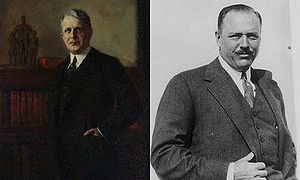

The U.S. Congress passed the Davis-Bacon Act in 1931 during the Great Depression. The Act was named after its sponsors, Senator James Davis from Pennsylvania and Representative Robert Bacon from New York.

Origins

The impetus for the Act originated from Representative Bacon, who was responding to a construction project in his district. A contractor from Alabama had won the bid to construct a hospital in Bacon's district using lower-wage labor from the South. This upset Bacon, as he felt it undermined local workers who couldn't compete with the lower wages. Thus, he initiated the legislative process, eventually leading to the Davis-Bacon Act.

Initial Legislation

The Davis-Bacon Act of 1931 required that all contractors and subcontractors working on federal or District of Columbia construction contracts more than $2,000 pay their employees "prevailing" local wages. The Secretary of Labor determines this wage and is generally based on what workers in the same area are paid for similar projects.

The Act aimed to prevent contractors from entering low bids on government projects by paying their workers lower wages. This helped protect local construction labor markets by ensuring contractors couldn't undercut local wage standards to win federal contracts.

Why the Davis-Bacon Act Was Passed

The Davis-Bacon Act was passed to address the issue of unfair competition in the construction industry. Prior to its enactment in 1931, contractors would often hire low-wage workers from outside the local area, resulting in lower wages for local workers and an overall decline in labor standards.

The Act aimed to protect local workers by mandating that contractors pay prevailing wages and benefits on federally funded construction projects.

By ensuring fair wages, the Davis-Bacon Act not only improved workers' livelihoods but also promoted economic stability and increased productivity in the construction sector.

Amendments and Changes Over Time

Over the years, the Davis-Bacon Act has undergone several amendments and administrative changes. In 1935, the "Copeland Act" amendments required contractors to submit weekly wage reports, to prevent kickbacks and wage theft.

During the 1960s, fringe benefits were added to the Act's prevailing wage determinations, and in the 1970s, the Act's scope was expanded to cover a broader array of workers and types of work.

The Act has also seen periods of suspension, the most notable being by President Nixon in 1971 due to inflation and by President George H.W. Bush in 1992 after Hurricane Andrew.